22 July 2021

31 July 2021

UPDATE – January to July 2021

Corporate Highlights

New Chair for Storegga Alistair Buchanan, CBE, has joined the Storegga board as non-executive Chair. Alistair is a leader in the energy and regulated utilities sector and brings a wealth of knowledge and experience from his thirty plus years in the industry. For ten years he served as Chief Executive of Ofgem, the UK’s gas and electricity markets regulator. While at Ofgem, Alistair led the creation of regulatory structures for the offshore wind industry and the total revision of the onshore network regulatory regime.

International Investment Grows In March, we completed a second successful round of fundraising, securing funding from major international investors. Our cornerstone investor, Macquarie, made a second investment and there were new investments from GIC, Singapore’s sovereign wealth fund and Mitsui & Co. Ltd., the global trading and investment company. International Investment

Business Development Cooperation with Mitsui In addition to investing in the company, Mitsui has entered into a non-exclusive agreement with Storegga to initiate and progress CCS opportunities in Europe and the Asia-Pacific region. At Storegga, we anticipate a rapid adoption of CCS technology in the Asia-Pacific region as it drives to meet its climate commitments. This strategic cooperation will leverage Mitsui’s strong presence in the Asia-Pacific and Storegga’s technical expertise in CCS.

Joint Venture with Talos Energy Inc. in US Gulf Coast and Gulf of Mexico In June, Storegga signed a joint venture agreement with the independent US offshore energy company, Talos Energy Inc., to source, evaluate and develop carbon capture, and storage opportunities on the U.S. Gulf Coast and Gulf of Mexico (“GOM”), including state and federal waters offshore Texas, Louisiana, Mississippi and Alabama. Under the joint venture framework, the Partners will originate and mature CCS ventures with emitters, infrastructure providers, service companies and financing partners. Talos Joint Venture

Petrofac Alliance At the end of June, with a growing portfolio of projects in different stages of development, we entered into a Technical Delivery Alliance (“TDA”) with leading international service provider Petrofac. Under the alliance, Petrofac will provide capabilities, people, processes and systems to support Storegga in the delivery of low carbon energy projects in the UK and internationally.

M&G invest in Storegga In July, M&G became Storegga’s first UK headquartered institutional investor. M&G, the FTSE-100 listed savings and investment business with £367 billion in assets under management and administration, is Storegga’s fourth external shareholder, alongside Macquarie Group’s Commodities and Global Markets Group (“Macquarie”), GIC, and Mitsui & Co. Ltd. (“Mitsui”). M&G’s investment was made by its Catalyst team.

Project Highlights

Acorn Project and the Scottish Cluster

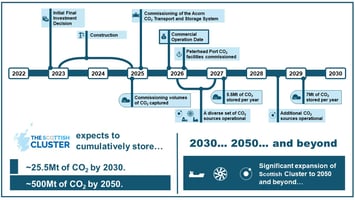

The Acorn Project is one of the most scalable CCS and hydrogen projects in the UK, and could be operational by the mid-2020s providing critical backbone infrastructure to the Scottish Cluster.

In March, over £30m of UK Government funding was announced for a suite of initiatives linked to the Acorn Project, taking Scotland a step closer to its net zero carbon goals. The industry match funded initiative, Scotland’s Net Zero Infrastructure (SNZI) programme, brings together academic and industrial partners to develop a major package of work designed to progress national low carbon infrastructure.

On 16 April, the Acorn Project took a significant step on the road to a final investment decision when Storegga (through subsidiary Pale Blue Dot) signed the Acorn Development Agreement as equal partners with Shell and Harbour Energy. Storegga is lead developer working closely with its partners to maximise the teams collective skills and experience.

In July the Scottish Cluster submitted their proposal into the BEIS Cluster Sequencing Process and announced MOU’s with several of Scotland’s major CO2 emitters: SSE for the new Peterhead Carbon Capture Power Station, INEOS, Petroineos and Shell, Exxon Mobil and North Sea Midstream Partners – owners of two terminals at the St Fergus gas terminal.

Direct Air Capture

Storegga and its partner, Carbon Engineering, are developing a UK commercial scale Direct Air Capture (DAC) plant that will permanently remove between 500,000 and one million tonnes of carbon dioxide from the atmosphere annually by circa 2026.

In April, Storegga was awarded government funding under the BEIS Direct Air Capture and Greenhouse Gas Removal Technology Innovation Programme. The funding is for a project to advance Carbon Engineering’s DAC technology by researching and developing low-carbon hydrogen or wind-generated electricity as alternatives to the natural gas which currently drives the calciner process.

In June, the partners announced that they have commenced Pre-Front End Engineering and Design of the DAC facility, following a successful feasibility study completed in the first half of 2021. Targeted for north east Scotland, the proposed facility will be the first large-scale facility of its kind in Europe. This project will complete in Q1 2022, with detailed engineering expected to follow in succession.

Decarbonising Highland Distilleries

Storegga led a four-month feasibility study to assess the potential of producing green hydrogen to supply leading whisky distillers in the Scottish Highlands with a low carbon energy source. The study found that the Cromarty Firth would be the ideal location for the UK’s largest green hydrogen electrolyser to date.

The North of Scotland Hydrogen Programme ‘Distilleries Project’ study identified a number of sites around the Firth deemed fit to host a 35MW electrolyser facility by 2024, producing up to 14 tonnes of green hydrogen per day. The hydrogen would be used by the distillers to heat their malt processing plants. This initial study covered the infrastructure needed to create a Cromarty Firth hydrogen